As per NASSCOM, startups in India saw a 108 per cent growth

in total funding from USD two billion in 2017 to USD 4.2 billion this year. Some

of the other key points that have been highlighted include:

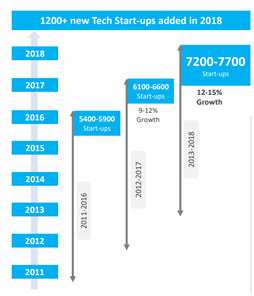

- More than 1,200 startups came up in 2018, including

eight unicorns, taking the total number to 7,200 startups started between

2013-2018.

- However, the seed stage funding of Indian startups has

declined from USD 191 million in 2017 to USD 151 million in 2018.

- 40,000 New Direct Jobs created; Total base 1.6-1.7

lakhs; 2.5-3.0x Indirect Jobs.

All these figures point

to the fact that the start-up scenario is improving in India but the only red

flag that remains is the lack of funding in the growth stage. It is great

danger that if the seeds are not watered enough, the plants may not grow. Late

stage VC funds may not find enough opportunities to invest in another Flipkart

or Ola. The risk capital in India is still a challenge and that is where bigger

funds may want to put in more capital to help seed companies to scale-up.

Seed Stage investments have fallen from $ 191 Million to $ 151 Million in

2018 vis-à-vis 2017 which is a drop of 21%. However this may be a cyclical

factor and as big names launch new funds for seed funding the situation may

become better in the coming years.

The good news is that the overall ecosystem is improving and many new startup

hubs are showing promising signs with cities like Hyderabad, Chennai, Pune and

Kolkata. These cities follow the key cities of Bengaluru, Delhi & NCR and

Mumbai. Another observation in the report include the technology areas of

startups. Most of these startups are working on Data Analytics, Internet of

Things, Artificial Intelligence, AR/VR, Blockchain. The key industries in which

start-ups are working include Fintech, Enterprise, Security, HealthTech and

Agritech.

The key drivers that are driving growth are the adoption of advanced technology

in B2B startups, rising focus on B2B solutions, uptake in growth stage funding

and improving support structures like incubators and International start-up

exchange programs. India already made a mark for itself as one of the largest

tech ecosystem in the world. This leads us to the fact that start-ups will

definitely be the growth drivers that will lead the country India to its next

stage of growth. Supporting this ecosystem, there is a large pool of talent and

business support companies operating in domains like accounting, business plan

writing, website development, legal and other areas. The growth is only set to

accelerate as more startups are opening up everyday and creating innovative

products and services across domains.

Another key factor are the Government initiatives that are starting to show

results on the ground. There are various initiatives that have been started by

the Government. The 10,000 cr startup fund that will be released through SIDBI

has already deployed INR 600 cr and funding received by 75 startups. Apart from

the Central Government, different state Governments also have schemes for

Startups. Other factors that are affecting the ecosystem positively are

investment by new cash rich entrepreneurs who are investing in new startups to

create a vibrant ecosystem.

All these factors are creating a positive impact and the momentum is only going

to become better in the years to come. There are some trends that the

Government can focus on is to create start-up hubs in different regions of the

country based upon the strengths of that region. This is inline with the

Fintech hubs of London or the cyber security hub in Israel. This will create

specialized startups which is one of the missing trends in the India ecosystem.

There are not many startups that work in deep tech and we will want to have

more of these.

Deep technology takes years to develop and once done it can spawn multiple

companies that work on that technology and offer services around that. I am

thinking of companies like Sun Microsystems, Microsoft, Oracle and a whole lot

of others that have created a universe for themselves supporting hundreds and

thousands of companies globally. Though those days are still some distance for

India to achieve we feel that we have made an excellent start.

2019 and beyond

As

per a report by Nasscom and Zinnov consulting, the total startups added in 2019

was 1300 + and the total funding received by startups was $ 4.4 billion. The

total number of active jobs created by these startups was 60,000. The sectors

that are in key focus are Enterprise, Healthtech, Fintech, HRTech, EdTech,

Retail and RetailTech, Travel and Hospitality among others.

If

we look at the horizontals or the key technology areas where there is focus

building-up, we have AI/ML, IoT, Big Data & Analytics, BlockChain, AR/VR,

Drones etc. Some of the encouraging points that we see in 2019 are as follows:

·

Total investment in start-up ecosystem has increased by

16% year-on-year in 2019 (Jan to Aug)

·

Distribution of funding was better compared to 2018 (Jan

to Aug) with early stage start-ups increasing their share

·

Only, seed stage investments have seen a drop in terms of

share and absolute terms. This is a Red Flag which

needs to be corrected with participation from the Private and Government funds.

·

In 2019 share of unicorns in total funding, was only 21%

against 48% in the previous year – reflecting the Indian ecosystem’s depth.

This is a positive side since the large investments drawn by unicorns makes the

investment data skewed. However, to sustain the ecosystem there needs to be large

unicorns that can keep spawning newer startups.

Some

more interesting facts! The key trends enabling the start-up ecosystem are as

follows:

·

Growth of new start-up hubs

·

Diffusion of deep tech

·

Building on the digital infrastructure

·

Increasing depth and breadth of sectors

·

More active corporate participation

Another

factor that is driving the startup ecosystem are the policy of the Government

that is helping the startup ecosystem to flourish. Proximity to the markets and

expanding talent base are some of the other factors that are driving the

ecosystem.

Yesterday,

12th April 2020, I was attending a webinar organized by Vishal

Gondal of goqii and had Rajan Anandan who is heading sequoia India and one of

the most established angel investors himself. The key areas that Rajan focused

were EdTech, HealthTech, Fintech and Enterprise especially the SaaS model which

they will look at closely going forward.

Another

area that I want to focus on as part of this article is the proliferation of

deep technology and especially blockchain within that segment. The key use

cases within blockchain are trade finance, Inter Bank payment, KYC, Claims

management etc. Other deep tech areas are drones, AR/VR, IoT and AI/ML. It will

be one of the areas that is expected to draw lots of investments.

There

is a term that has been used here which for me atleast was a first timer. It is

about demarking India as a market based upon household income. This data again

is from a BCG and Kantar IMRB study of 2017. There are 3 segregations as

mentioned below:

·

India 1: With a household income > $15,400

·

India 2: With a household income $2300 - $15,400

·

India 3: With a household income below $2300

In 2025 the

expected division of this market by millions and percentage will be as follows:

India

1: 48.8 million households representing 16%

India

2: 201 million households representing 66%

India

3: 55 million households representing 18%

These

figures give us a good direction of the target segment for all b2C startups that

have India as the target segment.

There

is an expanding addressable target market and an improving connectivity is

helping startups to connect and penetrate these markets. Digital connectivity

is the greatest boon that has helped India’s startups flourish. With a 40%

penetration rate and out of that 87% active Internet user, the base of Internet

usage is expected to grow significantly. All these factors are also attracting global

startups to set-up their base in India. They are also setting-up their R&D

centers in India to tap into the low cost talent pool in India. Some of the

other factors that are attracting these companies are improving institutional

support and increasing corporate R&D participation in the ecosystem.

With so much

said and much more to talk about, it is time to draw the line. You can always

refer to the “Indian Tech Start-up Ecosystem report” 2019 edition to learn more

about the startup ecosystem.

COMMENT(S)

LEAVE A REPLY