SMEs are Small and Medium Enterprises

defined by Government by their revenue. In India the Government has defined

businesses with revenue upto INR 50 million as a micro enterprise, those with sales

between INR 50 million and INR 75 million will be deemed as small and those with revenue

between INR 750 million and INR 250 million will be classified as medium-sized

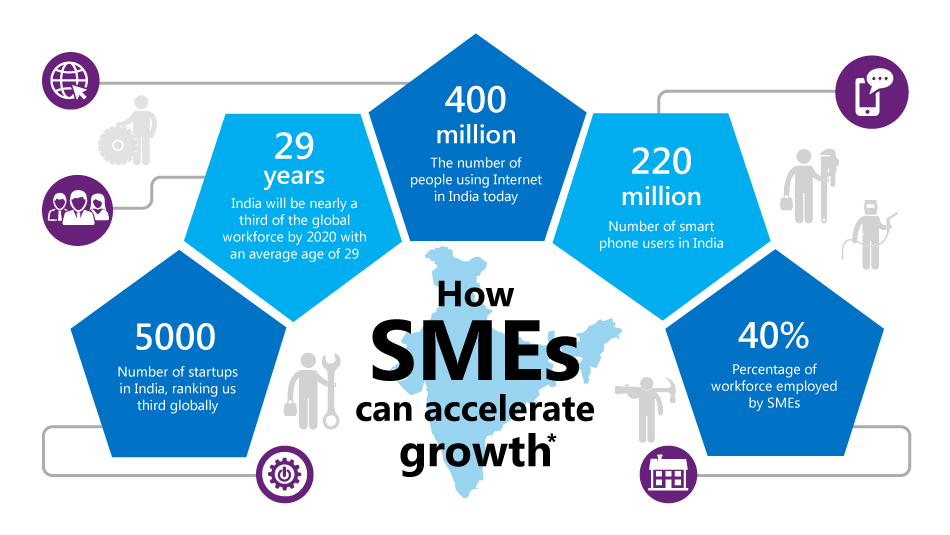

enterprises. It is well accepted fact that SMEs play a key role in driving

overall growth of economy. SMEs are drivers of economic growth and job creation

in developing countries.

They face challenges in terms of

capital expenditure, labor and other different issues. Here in this article, we

have tried to identify the key factors that help SMEs to grow?

Management Practices:

In any business, growth is not

linear. Therefore management practices play a crucial role in ensuring the

growth of the business. The business is successful only when there is a high

degree of operational and management efficiency that leads to higher

productivity. Therefore the management strategy should fit to the core business

of the company and be ready to adapt change quickly.

The key areas that have been

identified for improving management practices are internal controls, labor

benefits, strategic planning that includes fund raising and innovation. If

these areas are managed well then the company can scale up faster that the

market. They should have feasibility studies conducted for the business and dynamically update the data as required.

Talent Management: Employees are of great importance in

ensuring growth of a business. Businesses become successful when they align

staff performance to wider business targets. This helps in augmenting the

process of achieving short term and long term goals.

In that context, it is worthy to

mention that, not only productivity of staffs but also their behavior must be

aligned with overall organizational goal. Teams and employees are able to achieve

monthly goals set when they are motivated, compensated adequately and there is a

desire to achieve the broader organizational goals. Some of the key factors

that we have identified for talent management are:

It is understandable that for SMEs

there is not much space to promote employees. Therefore they can be delegated

greater responsibility so that it sums up to more of a horizontal promotion for

them. Create physical or online groups in the office so that they can get

involved in some activity on a Friday.

There can be several such activities

but the broader point that needs to be reflected is how employees can be kept

motivated at all times.

Adoption of Technology:

If we are not technologically up to

date we will suffer as we’re going through a digital revolution. The companies that

failed to make themselves technology intensive have disappeared from the

market. Technology can be costly in initial stages of the business. But, it

gives considerable competitive advantage by reducing cost of productivity and

enhancing quality of productivity.

It is difficult for SMEs to install

robotics in its operations. Dedicated industrial robots can limit small and

mid-sized manufacturers who often have small production batches and require

fast change-over. But, these issues are solved by innovative Universal Robot.

It is easy to install and reprogram, less spacious and redeployable in multiple

locations. Thus, using this technology SMEs which are operating in the

manufacturing industry can achieve economies of scale which contributes

positively in achieving growth in the business.

Based upon my experience of working

with the SME sector, I have seen that some SMEs are moving towards

implementing better technology. For example a SME Agri Implement Manufacturer

can use powder coated painting for the products which is parallel to what large

manufacturers do.

R&D and Innovation:

It is known that R&D and

innovation are key reasons for growth of a business. Without it a business,

product and service become cliché and ineffective. TR&D and innovation has

made Apple Inc. and Google distinct from other companies. But, all the SMEs do

not have the capacity to invest in R&D. However, if it fails to innovate,

it fails to achieve growth.

However, SMEs are, on average, less

innovative than large companies. For example, across OECD countries, the median

value in the national SME share of business R&D is 35%. That is why it

takes time for many SMEs to achieve high growth in initial stages of the

business.

India spends around 0.8% of its GDP

in R&D. Government, business and universities are the key sectors where it

spends on R&D. In 2018, it spent $29,066.8 million in government sector, $17,044.0 million in business sector and $1,952.3 million in universities. However, there are no defined

figures of how much is being spent on SME R&D. Thus, investing in R&D and

innovation in SMEs is still not considered high priority.

Networks and External Engagement:

The key notion of business is selling

products and services and earning revenue. Therefore, the businesses which have

better network and external engagement are able to generate revenue easily. It

allows these SMEs to develop better engagement with existing clients to enhance

the expansion of the present client base easily which results in a consistent

growth from early stages of business.

Most of the SMEs focus on listing their

business in various classified sites, participate in forums, post blogs,

conduct events and forge partnership for enhanced networking and better external

engagement to ensure growth of business. In India SMEs participate in various

events conducted by NASSCOM, ASSOCHAM and other to expand their clients base.

Online promotions that include Social Media and Google advertisements are also

becoming a key channel to promote SME business.

Access to Funding:

High-growth SMEs are not just more

likely to seek external funding but also a broader range of funding options to

suit their scale-up needs. The companies build an external funding network. It

helps to diversify funding sources and reduces the risk of investment. However,

many low-growth SMEs misses out on this opportunity due to various reasons such

as not-so-attractive business idea, restricted scope of generating revenue and inability

to refund on time.

That is why formal banking system refrains

from investing in small and medium sized businesses. An analysis conducted by

IFC revealed that, there is an approximate amount of $240 billion credit gap in

India. In India, micro, small and medium enterprises are responsible for around

30% of economic output and it provides employment to around 111 million people.

However, the growth in Fintech industry in India shows a new hope for SMEs to

access required funds for its businesses. According to PwC report, Indian and

global venture capital investors are more inclined to invest in this segment.

Governmental policies: India is expected to be a $5 trillion

economy by 2025. The country was recently termed as truly emerging market in

Asia at the moment. In 2019, the SMEs have been identified with 60% increased

in offering app-based services. Thus, they are increasingly becoming technology

intensive. However, this was impossible to happen ten years back. The budget

crunch and lack of business scope were played as key reasons. Various positive

government initiatives played key roles to enhance confidence among

entrepreneurs to invest in their startup.

Key government policies that has

helped SMEs to startup are MSME business loans in 59 minutes, MUDRA

(Micro-Units Development and Refinance Agency), CGMSE (Credit Guarantee for

Micro and Small Enterprises) loan, NSIC (National Small Industries Corporation)

loan and CLCSS (Credit Link Capital Subsidy Scheme).

These funding schemes and loans have

enabled SMEs to overcome the problems faced by credit gaps in the industry. In

it worth to mention that MUDRA scheme helped many micro enterprises to avail

funding help of INR 50,000 while it enables to access loan upto INR 10 lakhs.

Therefore, these diverse financial

facilities catering to unique need of micro, small and medium sized enterprises

helped the SME segment to become as the futile seed of manifold growth of

economy within next few years.

In a concluding note it is worth

mentioning that SMEs are the backbone of Indian economy. The report published

by Goldman Sachs says small businesses are the engines of job creation in

America. It accounts for 29.6 million businesses in America. It comprises 99%

of US employment firms. It employs around 58 million people in America.

According the statistics provided by Federation of Small Business of UK, Small

businesses accounted for 99.3% of all private sector businesses at the start of

2018 and 99.9% were small or medium-sized enterprises (SMEs). Therefore, due to

the positive impact of various initiatives and existent external and internal

drives, India is steadfastly moving towards a right direction by ensuring scope

of growth across SMEs.

COMMENT(S)

LEAVE A REPLY